Fierce competition between supermarkets has led to the first monthly drop in food prices for more than two years, an industry body has said.

The British Retail Consortium (BRC) said prices in September were down 0.1% from the previous month.

Prices of dairy goods, margarine, fish and vegetables – which are often own-brand lines – all saw falls, it said.

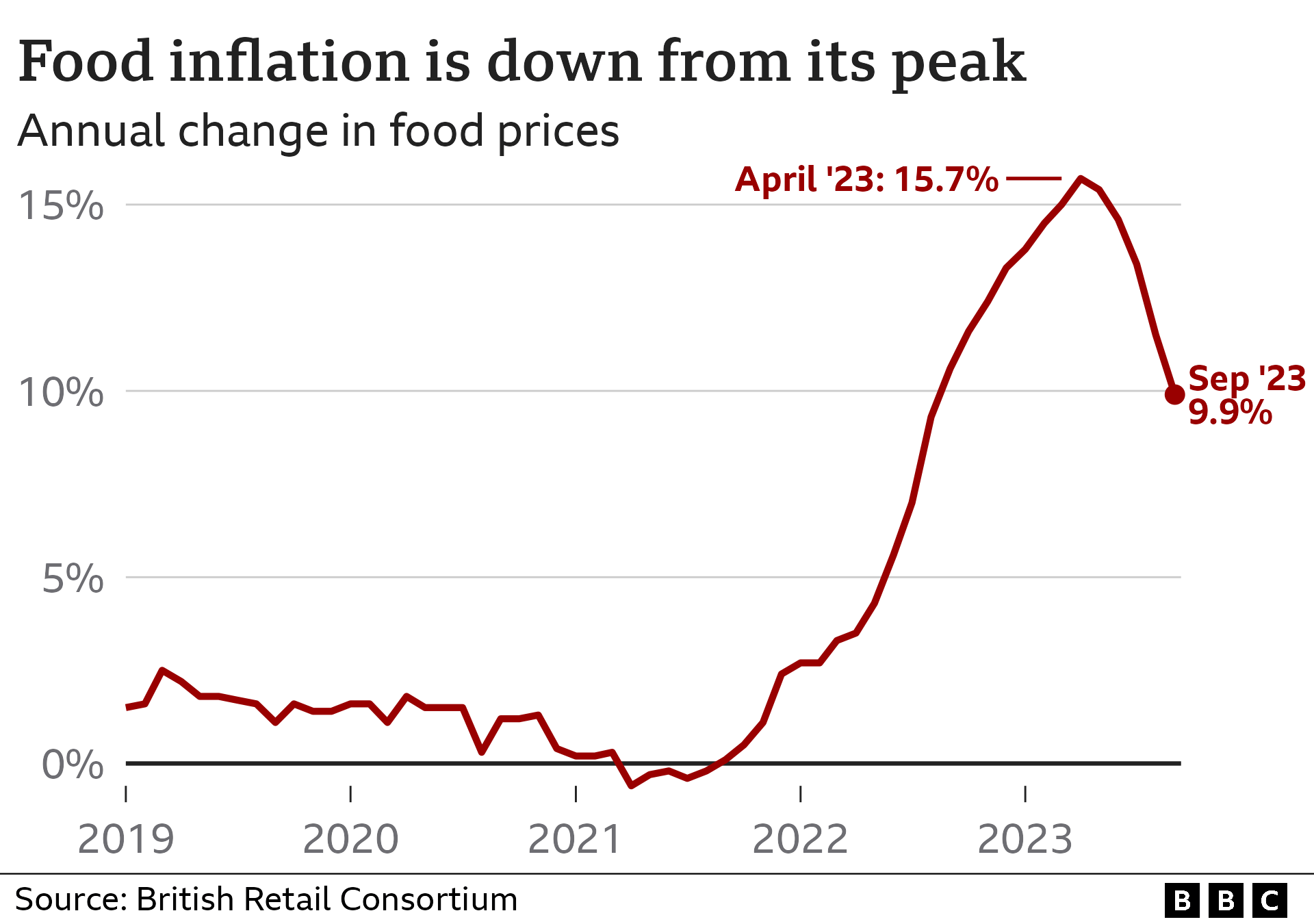

Grocery inflation – the annual rate at which food prices are rising – remains high but is starting to ease.

The BRC said food prices rose by 9.9% in the year to September, down from a rate of 11.5% in August.

Overall shop price inflation – which includes non-food items – fell to 6.2% last month, the lowest rate for a year.

The BRC said households had been helped by price cuts on school uniforms and other back-to-school items.

When the rate of inflation falls, it does not mean prices are coming down, but that they are rising less quickly.

The BRC’s chief executive, Helen Dickinson, said price rises were expected to continue to slow over the rest of the year.

“However, there are still many risks to this trend – high interest rates, climbing oil prices, global shortages of sugar, as well as the supply chain disruption from the war in Ukraine,” she added.

Speaking to the BBC’s Today programme, Rachel Kettlewell, the founder of Fearne & Rosie Jam, said her company had seen some costs starting to ease.

She said the firm – which supplies supermarkets such as Waitrose, Morrisons and Booths – had previously had to swap out raspberries in one of its products as costs had spiralled.

But now the cost of one of its key ingredients has started to fall, the company is starting to talk to shops about changes to prices and products again.

She pointed out, however, that its products are made up of many different elements, such as glass jars and paper labels, which are all seeing different price trends: “[So] even if you see a dip in one area of the product… it’s not as simple as saying that the end product is necessarily cheaper.”

Mike Watkins from NielsenIQ, which produces the shop price index with the BRC, also said that despite price cuts by supermarkets in recent weeks, “there continues to be pressure on budgets with over half of households still feeling that they are significantly impacted by the continued increases in cost of living”.

The BRC’s findings echo the recent official inflation figures, which showed that slowing food prices were behind a surprise fall in inflation in August.

The inflation rate dropped to 6.7% in the year to August, helped by falling prices for milk, cheese and vegetables.

The slowdown in inflation led the Bank of England to keep UK interest rates unchanged at its meeting last month.

Interest rates were held at 5.25%, bringing to an end a run of 14 consecutive rate rises by the Bank as it sought to keep inflation under control.

Bank governor Andrew Bailey said inflation was expected to continue to fall, but there were “increasing signs” that higher rates were starting to hurt the economy.

On Tuesday, bakery chain Greggs said that it had seen cost inflation easing across the business.

It reported a 20.8% rise in sales in the 13 weeks to 30 September when compared with the same period last year, while its boss Roisin Currie said that people were still “thinking about where to get the best value”.